Lo que los Gobiernos conocen acerca de tu Bitcoin y otras criptomonedas.

-

Chile, México, Estados Unidos, Spain, and other countries will exchange information.

-

The international crypto information exchange is set to begin in 2027.

¿En qué consiste el intercambio de información cripto internacional?

The Organization for Economic Cooperation and Development (OECD) has been promoting the implementation of a reporting regime for crypto transactions for a few years now, referred to as the “Crypto-Asset Reporting Framework” (CARF).

By the end of 2023, about 48 countries (including Brazil, Chile, Spain, United States, Estonia, Malta, Mexico, Portugal, Cayman Islands, and Gibraltar) committed to establishing a new international standard for automatic information exchange between their Tax Authorities starting in 2027.

The CARF aims for participating countries to exchange tax information regarding crypto transactions made by their citizens annually.

For example, if a resident in Brazil engages in cryptocurrency transactions on a Spanish exchange, once a year the Spanish Tax Authority will share information about these transactions with the Brazilian Tax Authority.

¿Y la “Travel Rule” o “Regla de Viaje”?

Driven by the Financial Action Task Force (FATF), the “Travel Rule” requires Virtual Asset Service Providers to share information with authorities in countries where they operate about senders and receivers of crypto transactions, for transactions exceeding $1,000.

Currently, few countries comply with this Travel Rule, including the UK, Switzerland, US, Cayman Islands, and Japan.

¿Los bancos y demás instituciones financieras también reportan?

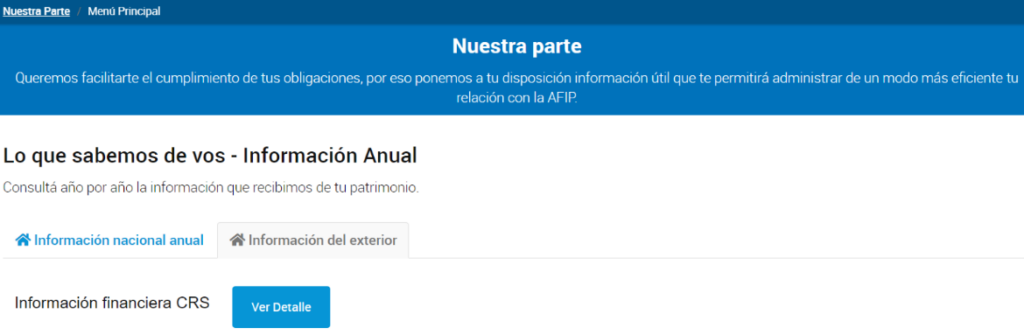

Yes, the Common Reporting Standard (CRS) created by the OECD a decade ago, which includes many countries (except the US), ensures countries gather and automatically exchange financial information from their institutions annually.

For example, if a person resides in Argentina and has a bank account in Spain, the Spanish bank will report to the Spanish Tax Authority, which will then inform the Argentine Tax Authority about the amount of money the Argentinian resident has in the Spanish bank.

Additionally, the Argentine tax agency now displays information about taxpayers’ accounts abroad on their website.

¿Cada país también tiene sus propios regímenes de información interno?

Besides the international reporting regime, each country also implements or will implement its own domestic regime. For example, in Argentina, local exchanges are required to report monthly information about each user to the Tax Authority if the user had transactions equivalent to around $360 during the month or if the account balance reaches at least $620 at the end of the month.

There is also a systemic reporting system in Argentina that exchanges operating in the country must comply with the Financial Intelligence Unit (UIF).

Disclaimer: The views and opinions expressed in this article belong to the author and do not necessarily reflect those of CriptoNoticias. The author’s opinion is for informational purposes only and does not constitute investment advice or financial advice in any circumstances.