Las estrellas se alinean para Bitcoin: ¿100.000 dólares en el horizonte?

-

‘Made Easy Finance’ predicts that bitcoin could reach up to 200,000 dollars in this cycle.

-

In general, the company forecasts a bullish trend for bitcoin until October 2025.

The price of bitcoin is currently strong above 72,000 dollars, nearing its most recent historical high reached in March 2024.

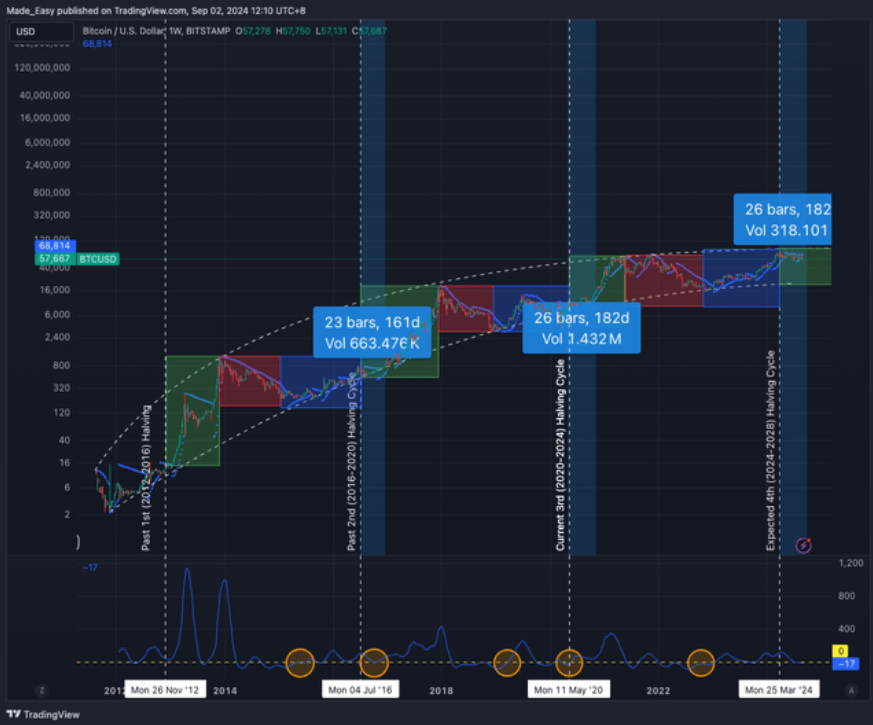

In the following graph, provided by TradingView, the movements of the digital currency throughout 2024 can be observed:

‘Made Easy Finance’, a financial analysis company, sees clear signals that BTC is “destined” to reach $100,000 in the near future.

Based on their research, the currency would be driven by a series of market factors pointing towards explosive growth.

Primarily relying on historical patterns, Made Easy Finance analysts assert that “the stars are aligned to see bitcoin at $100,000 or more” before April 2025, and could even reach $200,000.

The company has based its projections on two fundamental observations that, according to them, always accompany a bitcoin bull run towards a new high.

The first observed point is of a temporal nature. It is highlighted that the spike in BTC price usually occurs between five and six months after the halving. This is an event that occurs approximately every four years and halves the issuance of the digital currency.

According to the firm, the last halving suggested that BTC would reach its new all-time high between September 27 and October 17 of 2024, and although this did not happen on those exact dates, the asset came close, reaching $73,000 on October 29, as reported by CriptoNoticias.

The second key element in their analysis is the Coppock curve, a technical indicator developed by Edward D. Coppock that measures long-term rates of change.

This tool identifies the start of sustainable bullish trends in the market and, according to the firm, each time the Coppock curve turns positive, it anticipates the arrival of a bull market.

In the last two months, this indicator has finally turned positive for bitcoin as seen in the following chart. It is a signal that in the past has been a prelude to significant price increases.

The Coppock curve overlaps with these halving cycles. It is observed how the curve tends to coincide with the beginnings of new bullish cycles after each halving. This indicates a change in bullish trend and can be a signal to enter the market.

Price Projections and Growth Targets

Regarding price targets, Made Easy Finance sets an initial base price of $100,000, supported by technical factors and the psychology of round numbers that tends to influence financial markets.

However, the price could even double to reach $200,000, taking into account the starting price of $65,000 when entering the current bullish market.

This forecast is backed by historical analysis of previous cycles. In the 2012-2016 halving cycle, bitcoin experienced a 100x increase; in the 2016-2020 cycle, it grew 32x, and in the recent 2020-2024 cycle, it rose 8x.

Although performance has decreased in each cycle, Made Easy Finance is confident that “the current momentum will be sufficient to see prices above $100,000 in the coming months.”

Action Plan for the Coming Months

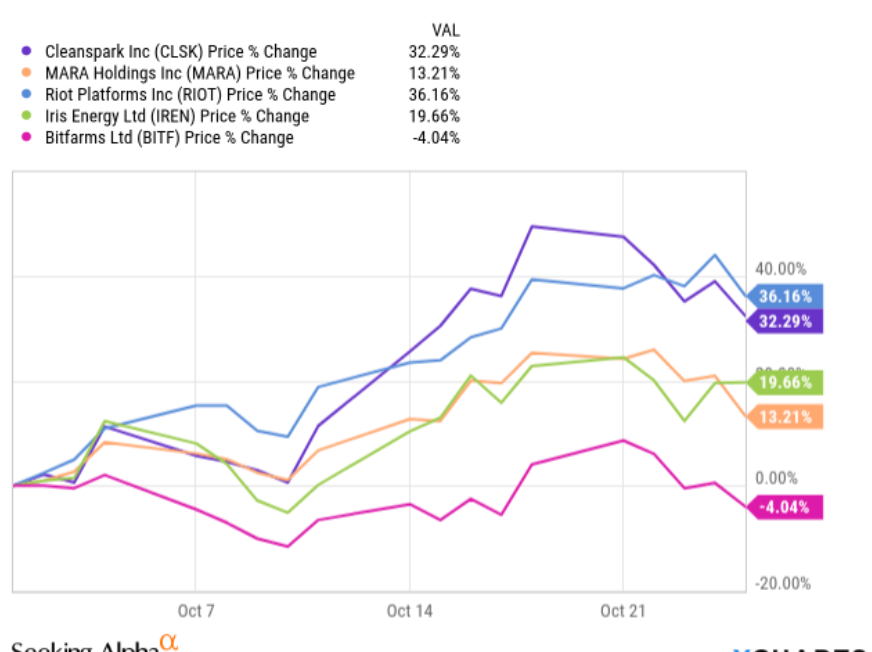

To capitalize on the trend, the company has implemented a strategy of investing in Bitcoin mining company stocks as a way to amplify returns.

At this moment, we have tilted our bitcoin portfolio towards CleanSpark Inc (CLSK) and MARA Holdings Inc (MARA). However, CLSK remains our top choice as it offers the highest upside potential and is the most undervalued in the sector based on bitcoin’s implied price. Additionally, we have also chosen MARA as a mean reversion play. This suggests that the investment in MARA is based on the idea that the stock price will eventually return to its historical average. If the current price is below this average, the stock is considered undervalued and there is a high probability that its price will recover.

Made Easy Finance, a financial analysis company.

The following chart shows the performance of the mining company stocks mentioned, with CLSK leading.