Las acciones de MicroStrategy alcanzan niveles récord.

MicroStrategy’s stock prices, led by CEO Michael Saylor, have reached an unprecedented peak of around $230 on Nasdaq. This figure sets a record in the company’s history.

According to data from TradingView, MicroStrategy’s shares have increased by 380% in just 9 months, rising from $48 in January of this year to an average of $230 in the current month of October.

This record in share prices is driven by two variables. The first is that MicroStrategy is the publicly traded company with the largest amount of accumulated bitcoins, with over 250,000 BTC to date. This is an investment strategy that has been followed for the past four years.

Overall, MicroStrategy’s strategy involves converting a significant portion of its cash reserves into bitcoin. This decision was driven by Saylor, who sees the digital currency as a true store of value, beyond market fluctuations. Since its adoption in 2020, the company has made consistent bitcoin purchases, investing over $16 billion in this currency.

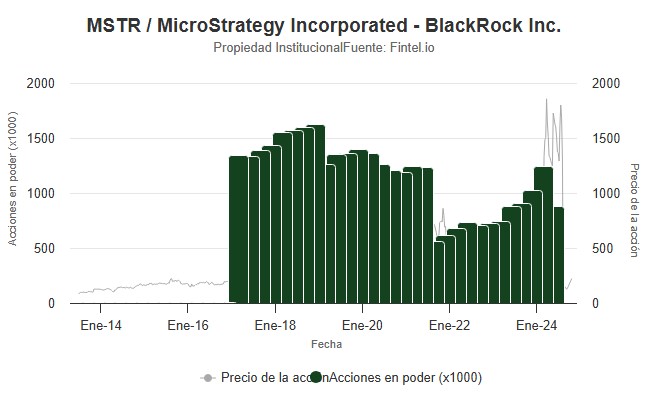

The second variable boosting MicroStrategy’s shares to historic levels is that the technology company has garnered the interest of major financial institutions and, consequently, they have invested in it.

BlackRock, one of the financial world’s giants and issuer of the world’s largest Bitcoin Exchange-Traded Fund (ETF), holds a significant stake in MicroStrategy, approximately 7.5%, owning 757,146 shares. This indicates that investment in MicroStrategy has become a form of diversification for those who already believe in the potential of bitcoin.

Another company with a significant stake in MicroStrategy is Vanguard Group, which currently holds 10.35% ownership of the company, equivalent to 1.5 million shares, according to Fintel data.

MicroStrategy has invested $15.8 billion in bitcoin so far. These continuous purchases have positioned the company on the map of investments in the world’s largest digital currency, demonstrating a strong commitment to the future of this technology.

Recently, CriptoNoticias reported that MicroStrategy outperformed the S&P 500 in performance thanks to its bitcoin investment strategy, demonstrating the sustainability of its business model based on the currency and showing steady growth since its adoption in 2020.

The rise of MicroStrategy’s shares to around $230 and its bitcoin investment strategy not only reflect a renewed interest in this asset, but also in the company as an investment vehicle.

With the backing of heavy financial institutions and a performance that exceeds that of traditional market indices, MicroStrategy could be on its way to becoming a key player in the global financial landscape.

MicroStrategy’s continuous bitcoin purchases have set a pattern that other companies, such as the Japanese Metaplanet, seem to be following. This Japanese company has adopted similar tactics, reflecting a growing trend among corporations towards investing in BTC, as reported by CriptoNoticias.