La valoración de la criptomoneda Avalanche se dispara debido a una nueva inversión de Grayscale

AVAX cryptocurrency price surges after a new announcement from digital asset manager Grayscale.

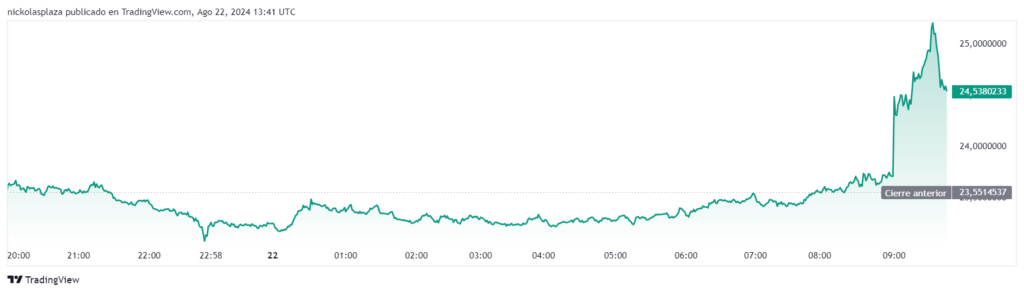

Within the last 24 hours, the asset’s value has increased by 6%, rising from 22 dollars to 25 dollars.

The performance of the cryptocurrency can be seen in the following TradingView graph.

The new fund, named Grayscale Avalanche Trust, offers investors direct exposure to the digital asset of the Avalanche smart contract platform, according to a press release from the company.

Grayscale, known for its investment trusts in digital assets, states that this fund allows accredited investors to subscribe daily and participate in exclusive AVAX investments.

The fund’s launch is part of Grayscale’s strategy to diversify its products, now adding Avalanche to its catalog of over 20 cryptocurrency investment products.

Franklin Templeton Expands Tokenized Fund to Avalanche

However, Grayscale’s move is not the only one driving Avalanche. Franklin Templeton, one of the world’s largest asset managers, has also integrated Avalanche into its money market fund, the “Franklin OnChain US Government Money Fund” (FOBXX).

This fund, designed to provide a high level of current income while preserving capital and liquidity, was already operating on the Stellar and Polygon networks and now adds Avalanche to its ecosystem, according to a press release.

The fund’s shares, represented by the BENJI token, are available on the mentioned networks and maintain the official ownership record through a patented transaction system, as explained by CriptoNoticias.

Each BENJI token is equivalent to one dollar and generates interest for investors, who can access the fund through Franklin Templeton’s investment app.

This financial product is aimed at both institutional and retail investors, who can also purchase tokenized shares using the USDC stablecoin.